Impact of UK's Tax-Raising Budget on Business and Inflation

Overview

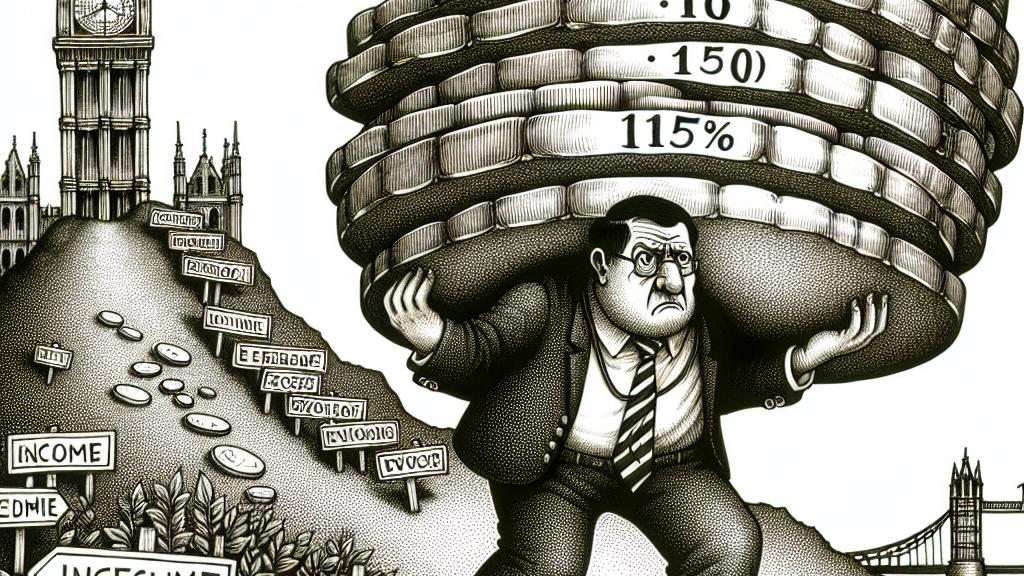

- The UK's new budget introduces steep increases in National Insurance taxes for employers.

- Businesses express deep concerns, fearing these tax hikes will curb hiring and escalate inflation.

- Political opposition criticizes the budget, warning it could hamper economic growth and jeopardize small enterprises.

Significant Tax Increases and Their Implications

In an ambitious—yet arguably risky—move, the UK government under Finance Minister Rachel Reeves has unveiled a budget that dramatically raises employer National Insurance taxes. This tax will climb from 13.8% to an eye-watering 15% starting in April 2025. With aims to raise an impressive £25 billion annually to address a troubling £22 billion fiscal shortfall, this plan has been met with mixed reactions. Consider, for example, the perspective of small business owners who often operate on tight margins; for them, such increased costs could easily mean fewer hires or even layoffs. As one bakery owner remarked, 'We want to grow, but these tax hikes make it feel like a daunting uphill battle.'

The Inflation Ripple Effect and Consumer Concerns

This budget doesn’t merely affect business owners; it threatens the economic fabric affecting every consumer. Analysts at Goldman Sachs have raised their forecasts for inflation, warning that businesses may respond to these tax burdens by hiking prices. Imagine walking into your local grocery store and realizing your weekly bill has ballooned due to soaring prices—this is no longer a far-fetched scenario. Roger Barker, a prominent voice from the Institute of Directors, emphasizes this fear, stating that this tax burden is a 'major blow' that could stifle job creation and ultimately force companies to lower wages. But what happens when businesses are unable to afford raises while costs keep climbing?

Political Reactions and the Urgent Need for Balanced Solutions

As reactions swirl in Parliament, the Opposition, particularly the Conservatives, are vocally criticizing the budget for its potential to derail small businesses—the backbone of the UK economy. Small enterprises, which often face financial strains, may find themselves increasingly at risk. Rain Newton-Smith of the Confederation of British Industry states that this budget could create an environment where investment is painfully difficult. 'For small business owners, every penny counts,' she asserts. It’s a precarious balancing act for the government: while filling the fiscal gap is essential, the drive for a thriving economy must not be sacrificed. If these trends continue, the long-term viability of the economy hangs in the balance, and only time will reveal the ultimate impact of these financial decisions.

Loading...