Market Movers: Key Stock Stories for Friday

Overview

- Post-election market shifts are drawing sharp investor scrutiny.

- Healthcare stocks face steep declines amid policy changes.

- Critical retail sales data and earnings reports are set to impact market dynamics.

Market Reactions to Healthcare Appointments

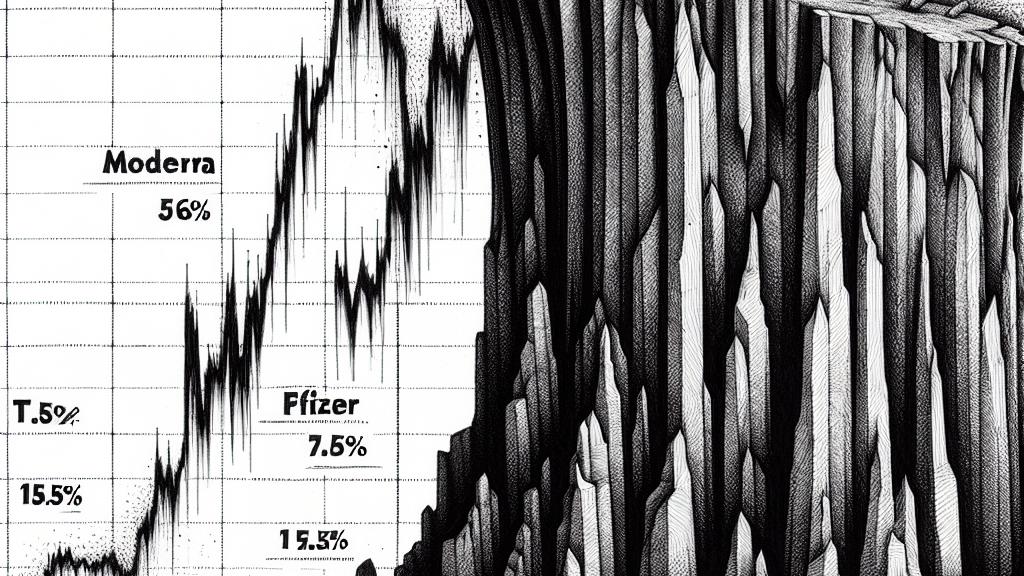

The recent political landscape in the U.S. has sparked significant volatility in the stock market, particularly after President-elect Donald Trump selected Robert F. Kennedy Jr. to lead the Department of Health and Human Services. This decision has raised eyebrows and concerns among investors, casting doubt on the future of vaccination policies. For instance, Moderna, which had been a darling of the biotech sector, saw its stock tumble by 5.6% in just one session, highlighting its quick descent from its May highs. Similarly, Pfizer, another key player, faced a downward spiral, dropping by 2.6% and now languishing 17.5% below its previous summer peak. These shifts illustrate how political decisions can ripple outward, significantly affecting financial markets and investment strategies, urging investors to reconsider their positions amidst evolving healthcare policies.

The Plunge of Electric Vehicle Stocks

Shifting gears to the electric vehicle (EV) sector, the atmosphere feels equally tense. Rivian Automotive reported a staggering 14% decrease in its stock value recently. This drop correlates directly with rising speculation around possible cuts to the $7,500 EV tax credit, which many believe could impact sales dramatically under the incoming administration. Meanwhile, mobile technology company Mobileye wasn't spared either, suffering a notable 10.5% drop. The picture becomes clearer when we consider Nio, which registered almost a 4% decline, and BYD, which lost about 3%. Such fluctuations reveal a broader apprehension about how policy changes can stifle innovation in this fast-growing industry, leaving investors on edge as they await more definitive answers on future regulations.

Anticipation for Retail Insights and Earnings Reports

As Friday approaches, there's a tangible buzz surrounding the retail sector, primarily due to the eagerly awaited retail sales report set for release at 8:30 a.m. Analysts are optimistic, forecasting a slight uptick that could revitalize retail stocks. For example, Grocery Outlet has soared by an impressive 27% this month alone, reflecting strong consumer appetite. If the upcoming sales figures live up to—or surpass—expectations, it could signal strong momentum moving forward, propelling stocks even higher. Moreover, eyes will also be fixed on Alibaba, which is due to release its earnings report. After climbing 14% over the last three months, many in the market are keen to gauge whether this momentum can continue against the backdrop of intensifying scrutiny of Chinese tech firms. These pivotal moments not only shape stock performances but can also redefine entire market trends, making them crucial for both investors and traders alike.

Loading...