Market Movements and Analysis: Key Stock Stories

Overview

- Costco's sales are surging, but its stock price raises concerns due to significant overvaluation.

- American Airlines is thriving with solid profits, showcasing exceptional operational efficiency amid industry challenges.

- Boeing faces critical credit risks stemming from ongoing strikes and management difficulties.

Spotlight on Costco

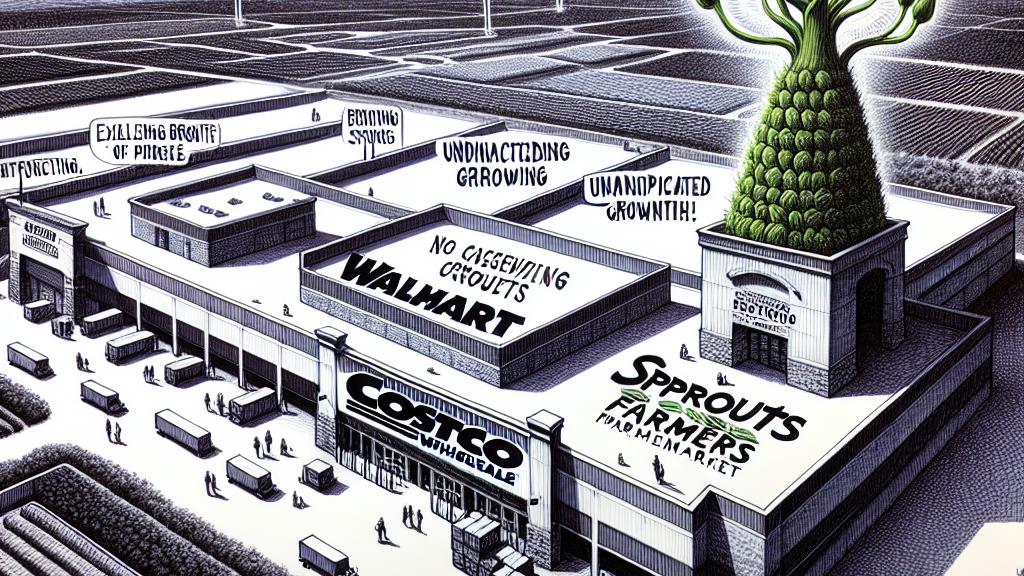

In the ever-evolving U.S. retail landscape, Costco Wholesale stands tall as a dominant force. As of October 8, 2024, its stock has seen an impressive surge of nearly 35% year-to-date. However, shares are currently priced around $890, which raises eyebrows because it greatly exceeds the estimated fair value of approximately $510. This stark contrast invites scrutiny from investors. Notably, Costco boasts remarkable membership renewal rates, consistently above 90%, indicating its strong customer loyalty. Nevertheless, formidable competitors like Walmart, which has made significant inroads, and Sprouts Farmers Market, experiencing a 140% increase this year, present a compelling challenge. Despite this, Costco continues to wow customers with its unique no-frills approach, offering high-quality products at bargain prices. It’s evident that Costco's unwavering commitment to operational excellence and value drives its sustained popularity, making it a captivating subject for investors eager to see how the retailer maneuvers through a competitive market.

American Airlines Soars

Turning our gaze to American Airlines, this airline has recently seen its stock soar by an impressive 6.9%. What fuels this surge? A steadfast commitment to operational reliability has led to remarkable profit performance, even against the tumultuous backdrop of the broader airline industry. The company reported record flight completion rates during the holiday season, achieving its lowest mishandled baggage rate ever. This dedication not only resonates well with customers but also translates directly into profits. While American reported a dip in quarterly net income—falling to $19 million from $803 million in the previous year—the adjusted earnings per share smashed through market expectations. Moving forward, the airline is optimistic about 2024, projecting adjusted EPS between $2.25 and $3.25, which exceeds analysts' forecasts. Such impressive strides highlight American Airlines' ability to adapt and thrive, making it a shining example of success in a fiercely competitive environment.

Boeing Under Pressure

In sharp contrast, Boeing, headquartered in Chicago, finds itself weathering significant challenges. The aerospace titan faces a daunting credit rating threat as S&P Global has placed its rating on a negative watch—an alarming indicator of its financial health. Ongoing strikes among machinists and persistent management malfunctions complicate the situation, resulting in a staggering 42% drop from its December highs. Investors remain uneasy, particularly as a potential downgrade to junk status looms, which would have dire consequences for borrowing costs and market sentiment. Boeing’s rich heritage as one of the leading aircraft manufacturers is overshadowed by these operational hurdles. Therefore, the emphasis on accountability, efficient management practices, and open lines of communication will be crucial for the company to regain investor trust. The journey ahead is challenging but pivotal, as Boeing must not only solve its existing issues but also ensure it remains a competitive player in a rapidly changing aerospace market.

Loading...