China Implements Export Ban on Key Minerals to the US

Overview

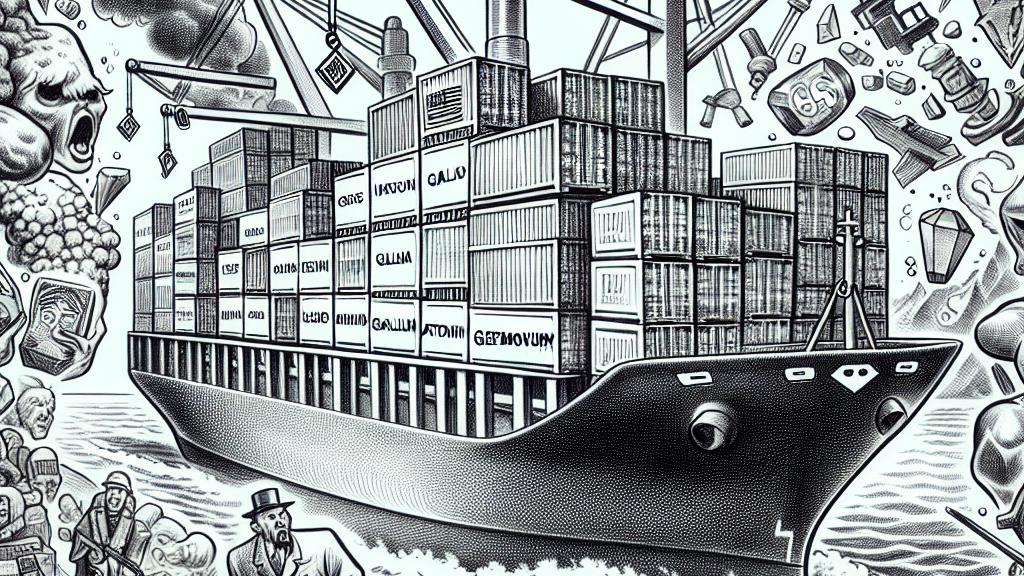

- In a dramatic escalation of trade tensions, China has imposed a ban on exports of vital minerals—gallium, germanium, and antimony—to the United States.

- This action not only serves as a strategic response to recent US restrictions on Chinese tech but also underscores China's commitment to safeguarding its national interests.

- With significant implications for global supply chains, the ban highlights the increasingly complex dynamics between the world's two largest economies.

Understanding the Context

In December 2024, China made headlines when it announced an immediate ban on the export of critical minerals, specifically gallium, germanium, and antimony, to the US. This bold move came just a day after the United States tightened its grip on China's semiconductor industry, demonstrating a clear pattern of reciprocal hostilities. Citing national security, the Chinese Commerce Ministry emphasized that these minerals are dual-use items, potentially applicable in both military and civilian technologies. By taking this decisive step, China aims to signal its commitment to protect its technological advancements and economic sovereignty in an increasingly hostile environment.

Impact of Export Restrictions

The effects of this export ban are substantial and far-reaching. For instance, gallium and germanium are indispensable in the production of semiconductors—used across various industries, from consumer electronics to defense systems. Imagine tech giants like Apple or Intel, who rely heavily on these materials, now facing uncertainty in their supply chain. Beyond semiconductors, these minerals are also critical for applications in fiber optic technology and solar panels, which further amplifies the stakes. Prior to the ban, the US had already experienced a downturn in shipments, yet this formal embargo now pushes American companies to the edge, forcing them to explore alternative sourcing options amidst rising costs. Notably, China has cornered the market, contributing a staggering 98.8% of the world’s refined gallium. Thus, businesses are now compelled to either delve into untapped local resources or seek partnerships in less reliable markets, amplifying their risk.

The Bigger Picture

Ultimately, this ban is a microcosm of the larger narrative surrounding the US-China trade war, a saga that has evolved dramatically since it began in 2018. This ongoing conflict has transformed from simple tariff disputes into intricate geopolitical chess moves, with each nation attempting to outmaneuver the other to gain supremacy in technology and trade. The recent spike in antimony prices—up by an astonishing 228%—highlights the precariousness of global supply chains, as industries around the world scramble to adjust. The reverberations of this conflict reach far beyond just American and Chinese businesses; companies worldwide are now prioritizing resilience through diversified strategies. In this charged atmosphere, both domestic and international players are watching closely, wondering how these two economic behemoths will navigate their turbulent relationship and what the long-term consequences might be for global trade.

Loading...