Banking Giants Raise Targets Amid Merger Tensions

Overview

- Recent earnings reports reveal a striking contrast between UniCredit and Commerzbank amid looming merger discussions.

- While UniCredit celebrates an 8% profit increase, Commerzbank faces a 6.2% decline yet remains optimistic for 2024.

- Political dynamics and regulatory challenges significantly impact the potential merger in Europe’s banking sector.

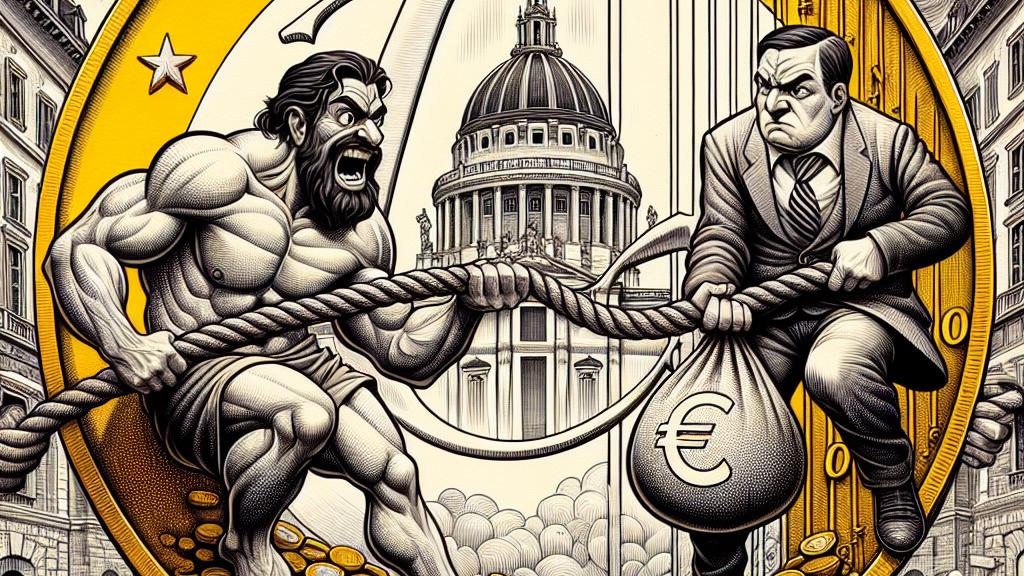

The Financial Tug-of-War

In the dynamic world of European banking, a captivating financial drama unfolds between UniCredit, Italy's prominent banking institution, and Commerzbank, a stalwart of the German financial landscape. Recently, these rivals published their third-quarter results, and the contrast couldn't be starker. UniCredit showcased its financial fortitude with an impressive 8% rise in net profits, totaling 2.5 billion euros—surpassing the expectations set by analysts. Conversely, Commerzbank reported a modest decline in profits, falling by 6.2% to 642 million euros. Remarkably, despite the dip in earnings, Commerzbank's leadership remains buoyant, raising its outlook for 2024, demonstrating tenacity and strategic flexibility in the face of adversity.

Strategic Moves and Competitive Spirit

This interplay of fortunes highlights a vibrant competition between the two banks. Notably, UniCredit isn't just sitting on its laurels; in a bold maneuver, it has amassed a significant 21% stake in Commerzbank, a move that seems both strategic and provocative. This action has sparked conversations around the possibility of a full merger. On the other hand, Commerzbank's new CEO, Bettina Orlopp, is determined to steer her bank through this challenging landscape. She calmly emphasized that despite facing heightened risk provisions and fluctuating interest rates, Commerzbank's commitment to improving profitability remains unwavering. This ongoing tussle not only captivates investors but also highlights the complexities of modern banking, where adaptability and strategy are paramount.

The Regulatory Maze Ahead

Yet, amidst this spirited competition, significant hurdles remain—especially from a regulatory perspective. Chancellor Olaf Scholz has expressed concerns about the aggressive moves by UniCredit, calling for caution and consultation instead of hostile takeovers. With the German government holding a crucial 12% stake in Commerzbank, their influence cannot be underestimated. Following Orcel's earlier comments about taking a full year before making any merger-related decisions, the atmosphere feels charged with anticipation. Stakeholders are left pondering whether a partnership based on mutual growth is attainable or if the rivalry will only harden. As both banks proceed through this regulatory maze, investors, analysts, and industry enthusiasts alike will undoubtedly keep their eyes sharply focused on their next steps, eagerly watching this high-stakes situation unfold.

Loading...