The Tax Strategy of American Wealthy: Charity Donations Before Passing

Overview

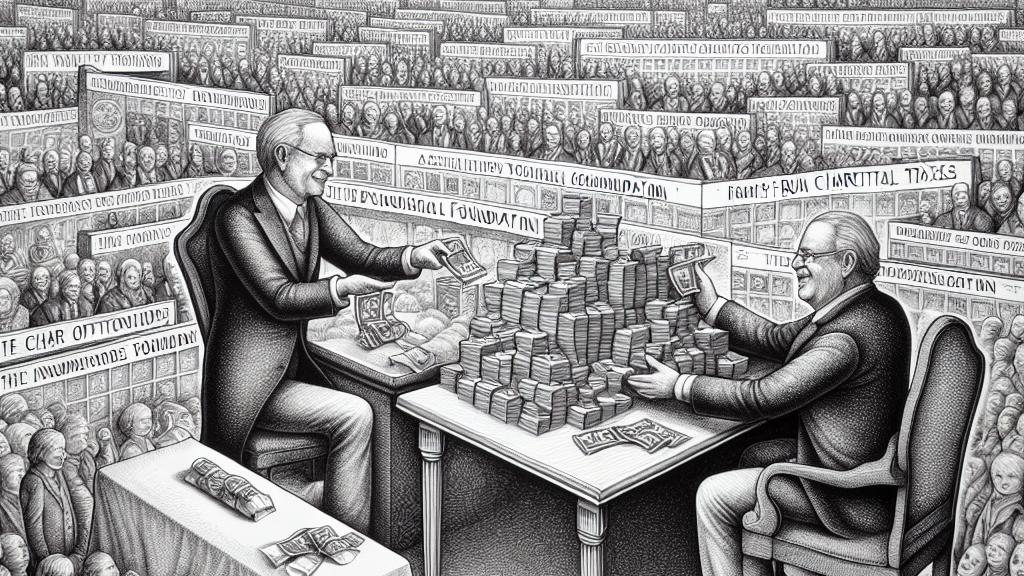

- Wealthy Americans strategically leverage charitable donations to minimize estate taxes.

- This approach reflects both a desire for legacy and a shrewd financial maneuver.

- Warren Buffett's example exemplifies how this practice operates at the highest levels.

The Landscape of Wealth in America

In the intricate world of American wealth, a notable trend has emerged: affluent individuals increasingly leverage charitable donations as a strategic tool to reduce their estate taxes. By gifting their wealth to family-run charitable foundations, these magnates not only secure their financial legacy but also fulfill societal obligations. For instance, consider the legendary investor Warren Buffett, who famously donated around $1.8 billion in Berkshire Hathaway stock to foundations overseen by his children. Not only does this decision reflect his commitment to philanthropy, but it also exemplifies a complex interplay between wealth preservation and public goodwill. Such financial strategies transform potential taxable inheritances into powerful legacies, illustrating how carefully crafted charitable giving can intertwine with effective financial management.

The Mechanisms of Tax Exemption through Donations

At the core of this financial strategy lies the nuanced mechanics of tax exemptions, which allow individuals to drastically lower or eliminate their tax responsibilities altogether. When affluent citizens donate to recognized charity organizations, they unleash a dual benefit—supporting noble causes while simultaneously enjoying substantial tax deductions. For example, organizations like the American Red Cross not only provide critical disaster relief but also reward their generous donors with significant savings on their taxable income. With the estate tax exemption limit hovering around $14 million, wealthy individuals can donate sizeable assets without incurring tax penalties. Imagine a billionaire carefully crafting a legacy that blends financial savvy with altruism, all while conforming to existing tax laws. This dynamic stretch of behavior reveals a fascinating aspect of how the wealthy navigate the landscape of philanthropy to create both social impact and financial advantage.

The Consequences on Wealth Inequality

However, within this seemingly benevolent practice lurks a troubling reality about wealth inequality in America. Recent findings from the Congressional Budget Office reveal that the wealthiest 10 percent hold an astonishing 60 percent of the nation's total wealth. This glaring inequality invites skepticism regarding the true motivations behind affluent donations. Are these charitable contributions genuine acts of kindness, or are they tactical maneuvers to perpetuate wealth avoidance without ethical responsibility? Through tax-exempt foundations, wealthy donors can maintain control over their assets while projecting an image of goodwill, effectively perpetuating their wealth without additional taxes. This situation sparks urgent conversations about necessary reforms in tax policy, equitable wealth distribution, and ensuring that charitable practices genuinely benefit society. As the country grapples with the ramifications of these strategies, it is clear that a collective reevaluation of priorities is essential for fostering a more equitable future.

Loading...