Building Shareholder Value: The Role of Activism in Reservoir Media

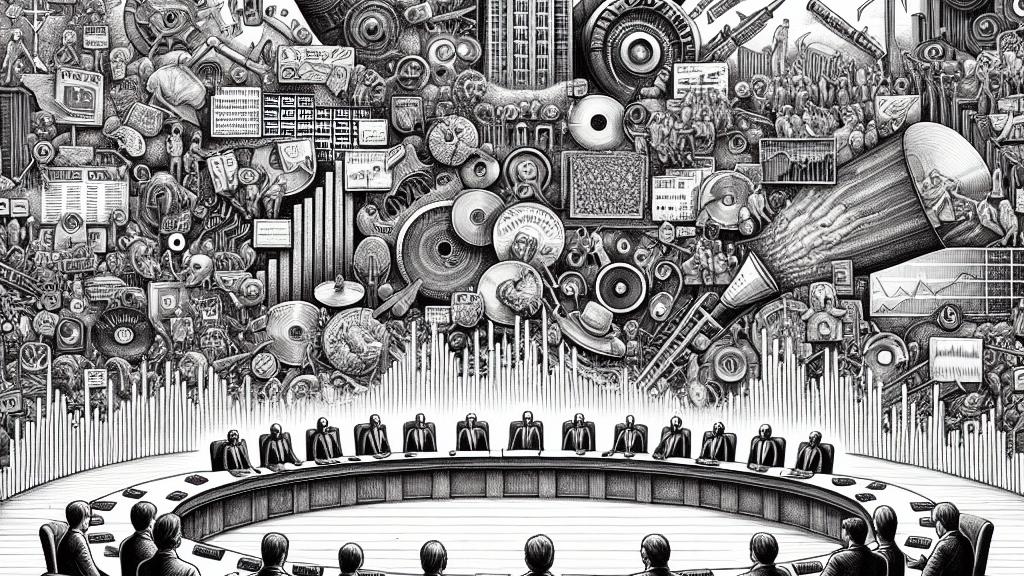

Overview

- Irenic Capital Management advocates for a strategic review at Reservoir Media to maximize shareholder value.

- Reservoir Media thrives in the music sector, representing a rich catalog of renowned artists.

- Activism seeks to uncover hidden opportunities, positioning the company for future growth.

Introduction to Reservoir Media

Reservoir Media, a prominent independent music company based in New York City, is renowned for its expansive catalog featuring legendary artists like Joni Mitchell, John Denver, and The Isley Brothers. Since becoming public in July 2021, Reservoir has showcased remarkable growth, managing over 130,000 copyrights and 36,000 master recordings. However, despite its impressive portfolio, shares have seen a decline of over 22.24% since its SPAC debut, trading around $7.59 as of early October 2024. This decline has drawn the attention of activist investors, highlighting the intriguing dynamics within the company.

Irenic Capital's Strategic Activism

Enter Irenic Capital Management, which holds a substantial 8.14% stake in Reservoir Media. Founded by experienced investors who are no strangers to shaking things up, Irenic is advocating for a rigorous strategic review. Their core belief? Reservoir's stock is 'substantially undervalued.' By taking steps to closely evaluate the company's operations and assets, Irenic aims to propose actionable plans that could enhance profitability and shareholder returns. For example, they might suggest divestitures or restructuring strategies that capitalize on the burgeoning subscription streaming market, which has grown significantly and is a vital revenue stream for the company.

Implications for the Future

The potential outcomes of Irenic’s engagement with Reservoir are far-reaching. If the board acknowledges these calls for change, Reservoir could be positioned not only to recover its share value but to thrive in a rapidly evolving music industry. We are witnessing an era where digital consumption is redefining success for music companies, and a strategic pivot may be necessary to harness these trends effectively. This is an exciting moment for both shareholders and music aficionados, as the shift towards modern strategies promises to open doors for collaboration, innovation, and ultimately, a revitalized firm. Indeed, how well Reservoir Media navigates these challenges will be crucial in establishing its place in tomorrow's music landscape.

Loading...