Germany's Capital Drain and Its Impact on Economic Competitiveness

Overview

- Germany is currently facing a critical economic crisis, with staggering capital outflows exceeding 100 trillion yen, threatening its prominent position in the global market.

- Renowned companies like BASF, Siemens, and ZF Friedrichshafen are increasingly relocating investments overseas, indicating a profound shift in investor sentiment and confidence.

- The combination of soaring energy prices, outdated technology, and bureaucratic hurdles is driving domestic businesses to seek more favorable environments abroad.

A Tumultuous Economic Landscape

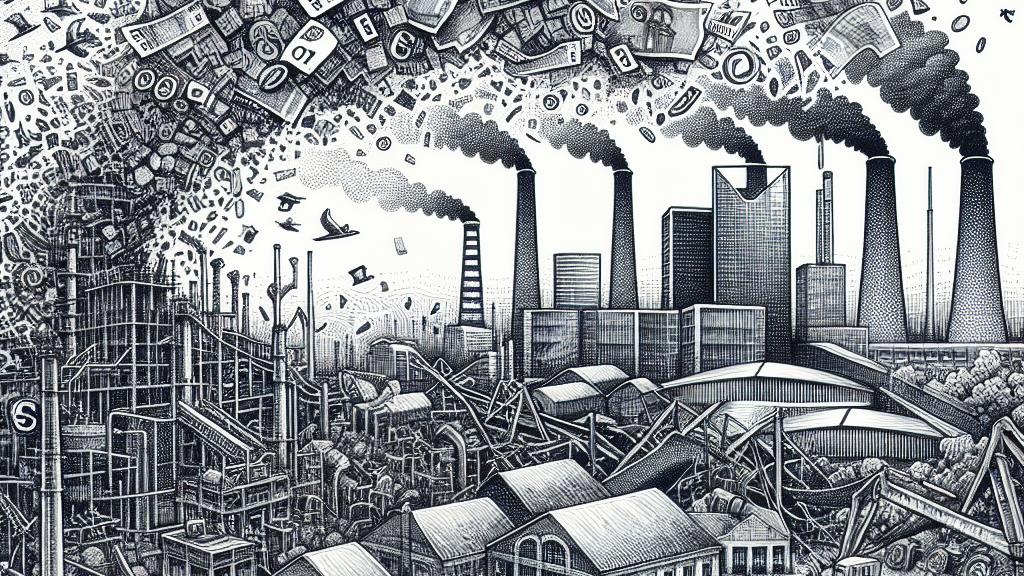

Germany, once the epitome of industrial success, now finds itself in a tumultuous economic landscape marked by alarming capital flight. Recent reports suggest that over 650 billion euros—an astonishing 100 trillion yen—have been siphoned out since 2010. Notably, a staggering 40% of this capital has evaporated since Chancellor Olaf Scholz’s coalition government assumed power in 2021. Take, for example, prominent corporations like BASF, which has made the difficult decision to relocate significant portions of its investment to foreign markets, a move that starkly illustrates the growing lack of confidence in Germany's economic future. This trend not only signals a collapse in domestic investment but raises serious questions about the long-term sustainability of Germany's economic model.

Political Uncertainty Worsening Economic Dilemmas

Adding fuel to the fire, political uncertainty has become a critical factor amplifying economic challenges in Germany. Citizens express growing dissatisfaction with the government’s performance, leading to a heightened discourse about early elections. This unrest creates a breeding ground for investor hesitation. As a direct consequence of geopolitical tensions, especially following former President Trump’s protectionist stances, German firms feel compelled to move investments to the U.S. For instance, the automotive giant Volkswagen is scaling back its domestic operations while intensifying its presence in more favorable markets abroad. Moreover, the excessive bureaucratic processes in Germany further exacerbate the situation, discouraging local projects and leading businesses to seek refuge in friendlier regulatory environments. The resultant vacuum leaves a significant impact on job creation and economic growth at home.

Charting a Course for Recovery and Renewal

To navigate out of this crisis successfully, immediate and resolute action is essential. Without a palpable commitment to creating a more inviting landscape for investment, Germany risks entrenching a pattern of economic stagnation. Siemens, for example, exemplifies the troubling trend by diverting the majority of its recent investments to international projects rather than fostering growth at home. Such decisions echo a broader narrative: dwindling investment undermines local job markets and precipitates innovation decline. Ultimately, for Germany to reclaim its status as a competitive force on the world stage, it must adopt strategic reforms that attract investment, potentiate industrial growth, and reinforce confidence across its economic sectors. By addressing these critical challenges head-on, the nation can not only stabilize its economy but also inspire a wave of renewed optimism and investment in its future.

Loading...